Understanding Trusts: A Guide to Revocable and Irrevocable Trusts

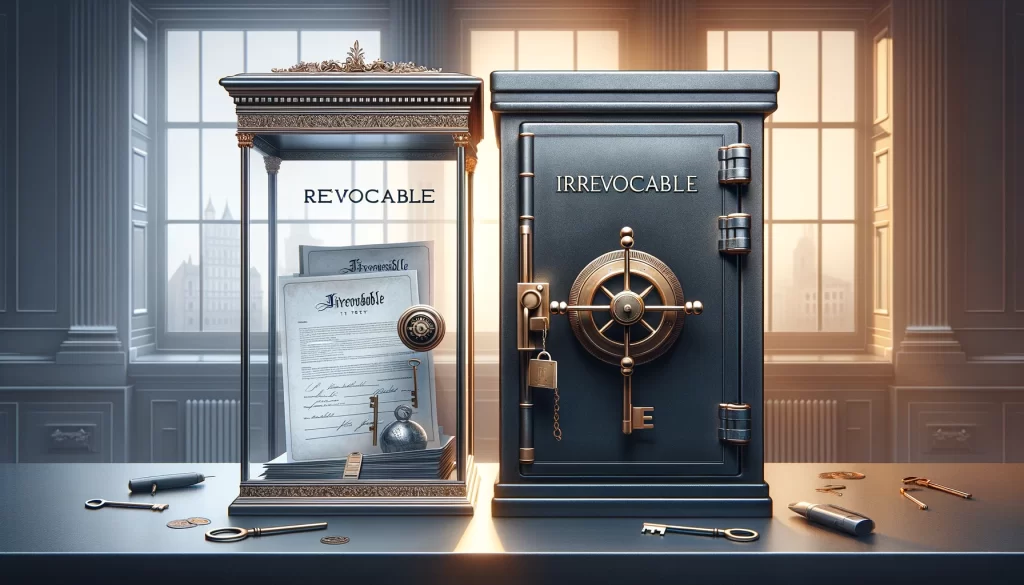

Welcome to our comprehensive guide on understanding the differences between revocable and irrevocable trusts. Trusts are a fundamental element of estate planning, offering a range of benefits and options for asset management and distribution. However, navigating the complex landscape of trusts can be daunting, especially when it comes to understanding the distinct features and implications of revocable versus irrevocable trusts.

In this blog, we aim to demystify these two popular types of trusts. We will explore their definitions, highlight their unique characteristics, and delve into their respective advantages and limitations. Whether you’re planning for your estate, safeguarding your assets, or simply curious about trusts, this guide will provide you with the essential information to understand the key differences between revocable and irrevocable trusts, and how they can be effectively utilized in estate planning.

The Basics of Trusts in Estate Planning

At its core, a trust is a legal arrangement in which one party, known as the trustee, holds and manages assets on behalf of another party, the beneficiary. This arrangement is established through a legal document, where the terms and conditions of how the assets are to be handled and distributed are clearly outlined. Trusts serve as a pivotal tool in estate planning, offering a way to protect assets, manage wealth, and ensure that your financial wishes are honored. They can be tailored to specific needs, making them a versatile solution for a wide range of estate planning goals. Whether for asset protection, tax planning, or providing for loved ones, trusts offer a structured and secure way to manage and distribute assets according to your intentions.

Exploring the Flexibility of Revocable Trusts

Revocable trusts, also known as living trusts, are a popular estate planning tool due to their flexibility and control. A revocable trust is created during the lifetime of the trustor (the person who establishes the trust) and can be altered, amended, or completely revoked at any time before the trustor’s death.

Key Characteristics of Revocable Trusts:

- Control: The trustor maintains complete control over the assets in the trust. They can modify the terms of the trust, change beneficiaries, or dissolve the trust altogether.

- Privacy: Unlike wills, which become public record upon death, revocable trusts offer a degree of privacy as they do not go through the probate process.

- Ease of Transfer: Assets in a revocable trust can be smoothly transferred to beneficiaries upon the trustor’s death, bypassing the often lengthy and costly probate process.

Advantages:

- Flexibility: This is the most significant advantage. The trustor can make changes as their situation or intentions change.

- Avoids Probate: Assets can be distributed to beneficiaries without going through probate, which can save time and legal fees.

Potential Drawbacks:

- Limited Asset Protection: Since the trustor maintains control over the trust, the assets in a revocable trust are considered part of the trustor’s estate for creditor and legal purposes.

- No Tax Benefits: Unlike irrevocable trusts, revocable trusts do not provide tax advantages.

Revocable trusts are best suited for individuals who seek flexibility in their estate planning, wish to maintain control over their assets, and aim to provide a streamlined inheritance process for their beneficiaries.

The Permanence and Protection of Irrevocable Trusts

Irrevocable trusts are a type of trust that, once established, cannot be easily altered, amended, or revoked. This permanence is a defining characteristic and shapes the trust’s use in estate planning.

Key Characteristics of Irrevocable Trusts:

- Fixed Terms: Once the trustor establishes the trust and transfers assets into it, the terms are generally set in stone. This includes the appointed trustee and designated beneficiaries.

- Asset Protection: Assets placed in an irrevocable trust are no longer considered part of the trustor’s personal estate. This offers protection from creditors and legal judgments.

- Tax Advantages: Transferring assets into an irrevocable trust can reduce estate taxes, as the assets are no longer part of the trustor’s taxable estate.

Advantages:

- Estate Tax Benefits: Potentially significant tax benefits, including reduced estate taxes and, in some cases, income tax advantages.

- Asset Protection: Beneficial for those concerned with protecting assets from creditors, lawsuits, or other legal claims.

Potential Drawbacks:

- Loss of Control: Once established, the trustor relinquishes control over the assets and cannot alter the trust’s terms or reclaim the assets.

- Complexity: Often more complex to set up and manage, requiring careful legal and financial planning.

Irrevocable trusts are ideally suited for individuals with substantial assets who are seeking to reduce estate taxes, protect assets from creditors, and are comfortable with the permanence and loss of control associated with this type of trust. It’s particularly beneficial for those who want to establish a legacy or provide for future generations in a legally protected and tax-efficient manner.

Deciphering the Differences: Revocable vs. Irrevocable Trusts

Understanding the distinctions between revocable and irrevocable trusts is crucial for effective estate planning. While both serve the purpose of asset management and protection, their differences lie in control, flexibility, and tax implications.

Main Differences:

- Control and Flexibility: Revocable trusts offer more control and flexibility. The trustor can modify or revoke the trust at any time. In contrast, irrevocable trusts are fixed and cannot be changed once established.

- Asset Protection: Irrevocable trusts provide stronger asset protection against creditors and legal judgments, as the assets are no longer part of the trustor’s personal estate. Revocable trusts offer less protection since the trustor maintains control over the assets.

- Tax Implications: Irrevocable trusts can offer tax benefits, such as reduced estate taxes, since the transferred assets are no longer part of the trustor’s taxable estate. Revocable trusts do not provide such tax advantages.

Choosing Between the Two: The choice between a revocable and an irrevocable trust depends on individual circumstances, including the level of control desired, the need for asset protection, and tax considerations. Those prioritizing flexibility and control might prefer a revocable trust, while those focusing on asset protection and tax benefits may opt for an irrevocable trust.

In conclusion, both revocable and irrevocable trusts have their unique advantages and limitations. Understanding these differences is key to determining which type aligns best with your estate planning goals.

Navigating the Legalities and Taxation of Trusts

Both revocable and irrevocable trusts come with distinct legal and tax implications that are important to understand for effective estate planning.

Legal Standings:

- Revocable Trusts: Legally considered part of the trustor’s estate, they offer limited protection from legal judgments and creditors. Upon the trustor’s death, the trust is often subject to probate, although the assets within the trust bypass this process.

- Irrevocable Trusts: These trusts are treated as separate legal entities. Once assets are transferred into an irrevocable trust, they are generally protected from the trustor’s personal legal issues.

Tax Implications:

- Revocable Trusts: For tax purposes, these trusts are typically transparent. The trustor continues to pay taxes on income generated by the trust assets as if they own them directly.

- Irrevocable Trusts: These can provide significant tax benefits. Since the assets are removed from the trustor’s estate, they may not be subject to estate taxes. Additionally, the trust itself is subject to its own tax rates and brackets, which can offer advantages in certain situations.

Choosing the right type of trust requires careful consideration of these legal and tax aspects, often necessitating consultation with legal and financial experts to ensure compliance and optimization of tax benefits.

Contact Battlefront Legal

Christopher R. Harrison, Esq is a registered attorney in the state of Nevada who stands out as a highly creative trust attorney who is dedicated to tailoring a trust that perfectly aligns with your unique requirements. His approach to estate planning is both innovative and client-focused, ensuring that your trust is crafted to serve your needs effectively.

If you’re looking to establish a trust that is as unique as your estate, reach out to Christopher Harrison. Call him today at (775) 539-0000 or click here to start the conversation about securing your legacy.